Data analysis by Becca Willcox and Luis Rodriguez de Cespedes

The beauty industry’s sustainability efforts aren’t happening at scale, with widespread greenwashing and a lack of transparency. However, the first deep-dive survey into the beauty industry’s sustainability also reveals that some innovative brands are leading the way, demonstrating that positive change is possible.

Key stats from the Beauty Sustainability Scorecard, revealed below in two parts:

- Poor ingredient transparency: 90% of beauty brands use fragrance ingredients, but 72% do not disclose the exact ingredients they use, raising concerns about potential health and environmental impacts.

- Living wage negligence: a staggering 84% of brands are taking no publicly disclosed action to ensure payment of living wages throughout their supply chains, highlighting a significant human rights issue in the industry.

- Animal testing concerns: despite “cruelty-free” being a popular buzzword, 78% of brands have no certification to show they’re not testing on animals, calling into question the industry’s commitment to ethical practices.

- Insufficient climate reporting: 80% of large beauty brands do not disclose their progress in meeting greenhouse gas emissions targets, mirroring a similar lack of transparency in the fashion industry.

- Refillable packaging shortfall: while 15% of brands offer refillable products for more than a third of their range, only 2% track and report on repeat purchases, raising questions about the real-world impact of these initiatives.

Table of contents |

Intro: are beauty brands taking action on sustainability?

One year ago, no one could confidently answer that question at scale.

Experts, of course, know what the key issues are. But there’s been little comprehensive data on how the sector performs at large. And so people have kept asking Good On You for answers.

Since 2015, Good On You has earned a reputation as fashion’s leading source of brand sustainability ratings, having assessed more than 6,000 brands all based on publicly available data. Millions rely on Good On You’s ratings: consumers consult them for shopping decisions, the retail industry evaluates brand portfolios with them, and major media outlets cite them in reporting.

To answer the demand for more information about beauty’s sustainability impacts, Good On You spent a year developing a rigorous methodology built on the principle of transparency.

In the report below, we reveal findings from this process in the first industry-wide study into brand sustainability initiatives. This resulting Beauty Sustainability Scorecard—based on in-depth ratings and a representative sample of 239 brands—reveals what actions the industry is taking to address its impacts on the environment, workers, and animals throughout the value chain.

Who produced this report and our big takeaway

Before we dive into the findings, I’d like to briefly introduce the team behind this scorecard and underline the one big thing the scorecard reveals about the beauty industry.

Firstly, I’m simply the scribe—I’m JD Shadel, editor-at-large at Good On You, where I lead data journalism and original reporting. In late 2023, I joined a call to kick-off what’s been one of the most eye-opening projects we’ve undertaken: documenting the process of rating the beauty industry on its underreported dark sides.

This scorecard spotlights a few of the dozens of issues our rating team uncovered in developing the methodology, led by sustainability veterans Kristian Hardiman, head of ratings, and Becca Willcox, beauty ratings manager. In the past 12 months, they’ve engaged dozens of experts, advocates, researchers, and sustainability professionals at several leading brands and retailers to ensure the methodology reflects the state of the industry.

Once the methodology was complete, I worked alongside Willcox and Luis Rodriguez de Cespedes, manager of Good On You’s data systems, to identify trends across the first batch of 239 rated brands.

The biggest thing we observed across the analysis? There’s a clear opportunity for brands to be more transparent. Beauty brands aren’t typically open about what actions they’re taking to address the many reported issues throughout their value chains. And even when brands are more transparent, there’s a shocking amount of information that’s not disclosed about where all of our products come from—and even the specific ingredients that go in them.

Beauty Sustainability Scorecard

The beauty industry likes to present a spotless face to consumers, but behind the scenes it’s, well, not so pretty. Beauty’s complex value chains have many nuanced and hard-to-trace impacts on the environment, on workers, and on animals.

The following scorecard spotlights a few of the issues covered in our methodology, with all the insights based on our initial ratings of 239 beauty brands (completed in September 2024). The sample includes the largest and most profitable brands; a blend of trending and drugstore brands; as well as small upstart brands with novel business models, painting a representative picture of the industry’s overall performance.

Methodology: rating brands on publicly available data

The Good On You beauty methodology covers 42 key issues across a brand’s entire value chain from agriculture and manufacturing through to packaging waste and what happens when consumers wash the products off their bodies. The issues are weighted according to their overall impact.

The methodology rates brands selling skincare, haircare, and makeup. Importantly, brands are rated entirely on publicly available data. Each rating considers brand and parent company reporting; 40-plus beauty certifications and standards; and third-party indices (ie CDP Climate and Water) and reports (eg investigations by credible organisations such as International Labour Rights Forum or Greenpeace, among many others). Our ratings also consider whether there have been any controversies reported in a brand’s value chain—such as regulatory action around misleading claims or labour rights abuses—and whether brands have since remediated them.

As in fashion, the beauty methodology also distinguishes between large and small brands based on annual turnover and using the definition set out by the European Commission. We proportionately apply more demanding standards to large brands as they inherently have greater impacts and influence.

The beauty methodology doesn’t consider consumer health, which is covered by a complex web of varying regulations around the world. Our focus here is on the components of their products that many brands would rather not talk about: the unsustainable dark sides of the industry such as microplastics in our oceans and the growing packaging waste stacking up in landfills. However, many issues in the methodology do also relate to our health, either directly (eg consumers have a right to know what ingredients go into the products they use) or indirectly (microplastics can have toxic effects on our environment, including on us).

For detailed information about our methodology, check out this dedicated guide to the Good On You brand rating system including:

- Key issues covered (including their weighting);

- Data sources considered (including 40-plus beauty certifications and standards);

- Why we only use publicly available information;

- What our five-point rating scale means.

Part 1: how the industry performs on 13 issues

Jump to an issue: 1. ingredient transparency; 2. packaging and circularity; 3. palm oil; 4. climate targets and disclosures; 5. ecotoxicity and microplastics; 6. water disclosure and reduction; 7. supply chain traceability; 8. living wages; 9. modern slavery (human trafficking); 10. mica use and human rights; 11. animal testing; 12. vegan brands; 13. coconut use and monkey labour.

Ingredient transparency

Vague and commonly greenwashed terms such as “clean” and “natural” proliferate in the beauty industry. But behind the scenes, brands are lagging when it comes to transparency around what ingredients—and, crucially, how much of each—go into their products. The reasons for beauty’s lack of transparency include complex supply chains, protected trade secrets, and a global regulatory landscape that typically doesn’t require brands to disclose their full ingredient lists including perfume ingredients. There’s a growing consensus that consumers have a right to know what exactly goes into the products they apply and inhale. But many brands hide sometimes dozens of a product’s ingredients behind terms “fragrance,” “parfum” and “aroma.” And these fragrances are in almost every category of beauty product. While many fragrances may be safe at small quantities, some ingredients haven’t been properly assessed for their impacts on human health and the environment.

Even beyond fragrances, when brands are disclosing their other ingredients, many aren’t telling you clearly what quantities a product contains. And many brands aren’t publishing this information online. This isn’t only a public health concern. Greater transparency is also key for assessing brand- and product-level sustainability claims: if the public can’t identify the ingredients and quantities in major products, no one can really tell if brands are prioritising lower-impact product formulations; reducing the use of ingredients linked to deforestation, for instance; or deceptively pushing products with a minuscule quantity of a trendy or lower-impact ingredient (eg such as upcycled and certified ingredients).

Fragrance ingredient transparency

‣ 90% of brands use fragrance ingredients but most—72%—do not disclose the exact ingredients they use.

Ingredient transparency (excluding fragrances)

‣ 75% of brands are disclosing ingredients lists online but are not providing any clear information on quantities used (ie weight, volume, or percentages).

Packaging and circularity

Packaging plays a central role in how brands build their visual identities and appeal to shoppers. Packaging design helps communicate a brand’s ethos, differentiate it in competitive product categories, and forge emotional connections with repeat customers. But all those profitable perks for the business also bring a lot of negative impacts on the planet. The industry continues to rely on virgin plastic packaging, and the vast majority of it never gets recycled. Plastic waste from the beauty industry saturates our landfills, leeches toxic chemicals into our rivers and oceans, and can take centuries to decompose.

Even so, packaging is, somewhat ironically, a commonly greenwashed issue where brands can confuse consumers into thinking their products are better for the planet than they really are. For example, many brands will promote how they’re using some percentage of recycled materials in their packaging, even when it often applies only to a tiny fraction of their overall product range. A handful of brands make circularity central to their entire product range—such as waterless products like soap and shampoo bars in plastic-free packaging. But despite some signs of progress, wasteful packaging remains the status quo and the industry’s sustained growth trajectory suggests it’s only going to worsen.

Packaging from recycled materials

‣ 40% of brands are using some consumer packaging that comes from recycled materials.

‣ But fewer than 5% of brands use packaging from recycled materials in the majority of their products.

Recyclable packaging and take-back schemes

‣ 38% of brands are using packaging that can be recycled.

‣ 15% of brands recycle (take back) post-consumer packaging, but only 7% are disclosing the amount.

Packaging from FSC certified materials

‣ 18% of brands use packaging from Forest Stewardship Council (FSC) certified materials.

Refillable packaging (at home and in-store)

‣ 15% of brands are offering refillable products—including at-home refills (11%) and in-store refills (4%)—for more than a third of their range.

‣ But only 2% of these brands are tracking and reporting on repeat purchases.

Banning single-use plastic samples

‣ Fewer than 1% of brands have banned single-use product sample sachets.

Designing products with minimal packaging

‣ 2% of brands design the majority of their products to minimise packaging (ie solid bars or concentrated formulas).

Closer look: “ghost refills”

Refillable products sound good in theory—buy the packaging once and then refill it for life. But the benefits are premised on brands designing and promoting seamless refillable options at scale as well as consumers actually using the refills. In practice, that isn’t typically happening yet at any significant scale. More often, we see “ghost refills”—which is to say, brands promote a small number of refillable products but then are not transparent about whether consumers are actually following through.

The problem begins with the limited availability of refillable products. Few brands offer comprehensive refillable options across their product range. And for the few brands that do offer some, either in-store or at-home, there’s limited data about whether refills have a lower environmental footprint since only 2% of brands are even tracking and reporting on the refillable uptake. At-home refills are often merely a larger size product, sold in plastic packaging in a bulk quantity, ie the theoretical reduced impact from less packaging only happens when consumers repeatedly refill. Without transparency, these “ghost refill” products don’t have a lot of data to back up their efficacy. Clearly, brands should be designing their product offering with more circular thinking, but without robust data to back up the claims made around refillable product offerings, it can become its own form of greenwashing.

Palm oil

Consider almost any kind of beauty product—including moisturisers, soap, shampoos, conditioners, and makeup—and it’s likely to use ingredients derived from palm oil and palm kernel oil. But despite how prolific this commodity is, most consumers wouldn’t immediately know, as it can be hidden behind more than 200 different names on ingredient lists. One reason palm oil ranks among the most commonly used ingredients in the industry is its versatility: as a natural emollient, palm oil features prominently in products that moisturise the hair and skin, and it’s also a base ingredient in many makeups. Another reason is the high oil yield of the oil palm tree and the affordability of the ingredient.

But it has many dark sides. To meet the global demand for palm oil, farmers are clearing diverse tracts of rainforest, primarily in Southeast Asia where deforestation destroys habitats, displaces Indigenous peoples from their lands, and releases carbon dioxide into the atmosphere. Yet even with the many documented risks associated with palm oil, avoiding the ingredient doesn’t necessarily avoid the resulting concerns, as alternative ingredients can come with many similar issues (and may, in fact, be lower yielding). While certification schemes rightly face scrutiny, sourcing palm oil from suppliers certified by relevant schemes (ie the Roundtable on Sustainable Palm Oil) is one step brands can take to lessen risks associated with palm oil use.

Brands using palm oil

‣ 97% of brands use palm oil in at least some of their products.

Certified palm oil

‣ 56% are not using palm oil from any certified sources.

‣ 36% are using some quantity of RSPO certified palm oil and are disclosing the aggregate volume.

‣ 17% of brands are only using RSPO certified palm oil.

Closer look: certification criticisms

RSPO is one of the numerous data sources Good On You’s beauty ratings consider. And like a lot of widely scrutinised certification schemes, it’s faced criticism from environmental NGOs, as British nonprofit Ethical Consumer summarised in 2021. No certification scheme is perfect, but it’s a useful indicator for the state of the commodity and a step in the right direction for transparency in the beauty industry, as RSPO requires its members to report on their palm sourcing on an annual basis.

Climate targets and disclosures

The beauty industry’s impacts are far from trivial—especially when it comes to the many ways that brands’ value chains contribute to global carbon emissions. This includes everything from agriculture, transportation, production for products and packaging, and even how consumers use products.

In attempting to understand what emissions a brand is responsible for, emissions are often delineated into three scopes: Scope 1 refers to direct emissions in a company’s own operations (think emissions from owned manufacturing facilities). Scope 2 refers to indirect emissions from purchased electricity, heating, and similar utilities for a company’s own operations. Scope 3 refers to indirect emissions outside a company’s own operations (including upstream activities like production and transportation of raw materials as well as downstream activities like customer use and product disposal). Scope 3 activities typically have the biggest impact on the beauty industry’s overall emissions, but due to the challenges in measuring and addressing them, very few brands actually set comprehensive greenhouse gas emissions (GHG) targets covering all three scopes.

But even when brands set limited targets around scope 1 direct emissions, the vast majority of brands are not transparent about whether they’re even on track to meet them. There are some signs of progress—such as the number of brands disclosing to CDP Climate and receiving a top score—though overall, the beauty industry remains opaque on this crucial issue.

Large brands’ greenhouse gas emissions (GHG) targets

‣ 70% of large brands have some kind of GHG target, though they are not all comprehensive: 20% of brands have a scope 1 target; 20% have a scope 2 target; and 8% have a scope 3 target.

‣ 46% of large brands have an approved Science Based Target (SBT), with a further 6% committing to setting such a target.

Large brands not reporting their progress against GHG targets

‣ 18% of large brands publicly report that they are on track to meet their target, but this is the minority.

‣ 80% of large brands do not disclose their progress to meet their targets (this is, sadly, similar to other industries—in 2023, our analysis of fashion’s environmental track records found that most fashion brands with climate targets also don’t disclose their progress).

Large brands’ CDP Climate disclosures

‣ 60% of large brands are disclosing to CDP Climate.

‣ Of those that reported to CDP, 42% scored an ‘A-’ or above.

Ecotoxicity and microplastics

Many everyday beauty products contain ingredients to treat specific skin concerns, protect us from environmental stressors and, of course, limit the damaging effects of sun exposure. But many consumers aren’t aware that once we’ve washed off these topical products, lingering chemicals may end up harming the planet long after. There are hundreds of ingredients used in common beauty products that are often referred to as ecotoxic, meaning they’re known to cause negative impacts on the environment after we’ve finished with them. These chemicals can wash into our waterways and oceans, where they may harm aquatic life and even “bioaccumulate” in the bodies of aquatic species (including in species some people eat). Microplastics, which are often found in exfoliating products like facial cleansers, are one alarming example of ecotoxicity in beauty products, with more than 500 frequently used microplastic ingredients identified by campaign organisation Beat the Microbead.

Brands taking this seriously will research the impacts of their ingredients and product end-of-life (eg what happens when consumers rinse them down the drain); set clear targets to minimise the use of microplastics and other known pollutants; and disclose their progress. At the moment, few brands appear to be taking even the basic steps, even as the pollution harms our ecosystems (and, as a result, our own health, too).

Ecotoxicity and biodegradability policies

‣ 48% of brands have not published a policy or statement about assessing the ecotoxicity and biodegradability of their ingredients, suggesting they’re taking little action to understand and mitigate the environmental impact of their products’ end of life.

‣ 11% of brands are investing in significant research during product development and formulation to improve their biodegradability and ecotoxicity.

Suncare products and known pollutants

‣ 58% of brands sell suncare products, but only a fraction are taking meaningful steps to minimise their environmental impacts or address known pollutants.

‣ Of these, only 15% sell suncare products clearly free from pollutants on the respected Haereticus Environmental Laboratory (HEL) known pollutants list.

Microplastics

‣ 81% of brands are not clearly microplastic-free across their entire product range, though 11% of brands are microplastic-free for their rinse-off products (eg liquid soaps).

‣ 1% of brands currently have set a time-bound target to eliminate microplastics from their products.

Closer look: red-flag microplastics

Legislation in certain jurisdictions to address plastic microbeads has lessened their use, but many brands are still using synthetic polymers, commonly classified as microplastic ingredients. These include but are not limited to polyethylene (PE), polypropylene (PP), polymethyl methacrylate (PMMA), nylon (PA), polyurethane (PU), and acrylates copolymer. The Beat the Microbead campaign publishes a list of red-flag microplastic ingredients, which is a helpful guide to the synthetic chemical jargon commonly used in beauty ingredient lists.

Water disclosure and reduction

Many beauty and cosmetic products are mostly water. But beyond the prominent inclusion of water as an ingredient in beauty products, the industry puts stressors on freshwater supplies at nearly every manufacturing step—from the water used in agriculture through to the water-intensive production of packaging materials (eg cardboard and plastic). That’s not even to mention the end-of-life water impacts when consumers use rinse-off products like shower gel and shampoos.

While the beauty industry guzzles water, brands are taking only limited action to measure and mitigate the effects. One positive sign is the number of large brands that are disclosing to CDP Water, a global reporting project that encourages brands to be more transparent about their environmental impacts. We’ve tracked a sizable share of large brands that are disclosing to CDP Water and earning top scores. But beyond this positive indicator, the industry has much work to do: few brands appear to be taking meaningful water reduction initiatives in their supply chain. Large brands, who have the greatest water footprint and therefore responsibility to act, are mostly silent on the issue beyond CDP disclosure. Small brands don’t appear to be doing much on the issue, either, though a small number are taking leadership in developing more innovative “waterless” products or reducing water use in production.

Large brands’ CDP Water disclosures

‣ 55% of large brands disclose to CDP Water.

‣ Of those that reported to CDP, 60% scored an ‘A-’ or above.

Large brands’ (not disclosing to CDP) water initiatives

‣ Among large brands not disclosing to CDP, 80% do not appear to have implemented any water reduction initiatives.

Small brands’ water reduction initiatives

‣ 2% of small brands use rainwater in production.

‣ 2% of small brands use recycled water in production.

‣ 2% of small brands sell “waterless” products to consumers.

Supply chain traceability

When beauty supply chains are described as fully traceable, that means a brand can clearly track a product’s journey from the raw material phase through to the final consumer. But, alas, beauty’s complex supply chains remain largely opaque and untraced, and hardly any commonly purchased products are fully traceable. A few brands have made progress in tracing their final production stage, which is when a product is assembled and packaged (for example, the final production stage for lipstick would include common ingredients like refined shea butter, mica, pigments, and others formulated into the final product, which then gets packaged in tubes and labelled for retail). Brands often have more control over their final production stage, so more brands have traced that. In fact, it’s common for many large brands to own their final stage production facilities.

But few brands have traced their secondary or first/primary production stages. (In the lipstick example, the first production stage might entail mining mica or growing shea trees, and the second production stage might include the refining and processing of these raw ingredients.) Hardly any brands have traced all production stages. And even for brands that have traced only the final production stage, hardly any disclose comprehensive supplier lists. Compared with fashion, where it’s becoming more common to see detailed supplier lists (including name and address of suppliers and number of workers—not only country of manufacture), beauty brands lag. And when supply chains aren’t fully traced, the environmental and ethical risks compound.

Final stage traced, limited transparency

‣ 70% of brands have traced most (ie more than 90%) of their final production stage.

‣ But only 4% are publishing complete and detailed supplier lists (including name, address, or more for each facility).

Second production stage traced

‣ 6% of brands have traced most (ie more than 90%) of their second production stage, with a further 8% of brands having traced at least half (ie more than 50%) of the second stage.

‣ 47% of brands have traced none of their second production stage.

First/primary production stage traced

‣ 2% of brands have traced most (ie more than 90%) of their first production stage, with a further 3% having traced at least half.

‣ 42% of brands have traced none of their first production stage.

Living wages

Many beauty brands confidently promote their environmental initiatives. Often, as our reporting shows, they amount to greenwashed claims. But at least they’re talking about those issues. It’s a different story when it comes to a host of labour rights issues in beauty supply chains—brands seem to prefer silence. The fact is, there’s little to no evidence that brands today are taking any meaningful action to pay workers in their supply chain living wages. Almost all brands we surveyed don’t disclose even limited projects to improve wages.

The complicated nature of beauty supply chains and the limited progress towards traceability are a few reasons why there’s been little visibility on this crucial issue for beauty brands. But there’s also been a lack of scrutiny placed on these brands from consumers, media, and regulators. Workers in beauty supply chains deserve to be paid living wages, but at the moment, this profitable and growing industry fails to do even the bare minimum.

Most brands don’t mention living wages

‣ 84% of brands are taking no publicly disclosed action to ensure payment of living wages at any stage of production.

Some brands have limited living wage policies

‣ 9% of brands ensure living wages are paid to more than half of the workers in their final production stage.

‣ 12% of brands have an initiative in place to improve wages in their supply chains.

Closer look: living wage disclosures in fashion v beauty

The stats about living wages in beauty are alarming—and not that surprising when you compare the sector to other industries. As Good On You has rated thousands of fashion brands for nearly a decade, we’ve been closely tracking living wage policies. In 2022, we conducted analysis across large fashion brands in our directory and found a whopping 86% of large brands were taking no publicly disclosed action to ensure the payment of living wages at any stage of the supply chain, a number sadly similar to what we found when we analysed beauty.

Modern slavery (human trafficking)

The beauty industry’s long and complex supply chains, which typically span multiple countries and continents for even a relatively simple product, are uniquely at risk for modern slavery and human trafficking. The demand for certain “exotic” ingredients, often sourced from countries with weak labour protections, can lead to exploitation. Plus, the competitive nature of the market, which puts pressure on brands to keep costs low, can also lead to reliance on suppliers with unethical practices or limited transparency.

The good news is that a growing number of brands are starting to recognise their role in limiting the prevalence of modern slavery. In fact, most brands are doing something on the issue, with some initiatives in place. Most commonly, this includes reactive and easier-to-implement initiatives such as a confidential complaints mechanism, where workers in the supply chain can report suspected modern slavery. Far fewer brands are doing the hard work of engaging trusted anti-trafficking organisations to address the root causes, providing awareness training for suppliers, and ensuring regular third-party audits of their entire supply chain. Today, the status quo means modern slavery is a common risk. Our data below focuses on what large brands are doing, as they have proportionately greater risk—and influence.

Two-thirds of large brands are doing something

‣ 33% of brands have no measures in place to prevent modern slavery in their supply chains.

Some of the actions large brands are taking on modern slavery

‣ 42% of brands provide a confidential complaints mechanism for workers to report suspected modern slavery/human trafficking, though this is commonly only provided in the final production stage and rarely deep in the supply chain.

‣ 12% of brands provide modern slavery/human trafficking awareness training for their suppliers.

‣ 9% of brands are actively involved with trusted anti-trafficking organisations (eg Stop the Traffik).

‣ 7% of brands prohibit their suppliers from asking workers to pay recruitment fees.

Mica use and human rights

If it shimmers, it’s probably mica. This mineral is widely used in cosmetic products due to its dazzling properties—think eyeshadow’s glitter and sparkle, lipstick’s metallic and pearlescent tones, and highlighter’s radiant glow. If you wear makeup or nail polish, there’s a good chance that the products in your beauty bag contain mica. While the visual effects can be stunning, mica’s supply chains are plagued with human rights violations and are specifically at increased risk of child labour. Mica is primarily mined in India, where workers routinely experience hazardous conditions, with cave-in risks, respiratory problems, and exposure to harmful chemicals commonly reported. Low wages make it difficult for labourers to support themselves and their families. Therefore, many children are forced to work in mica mines, often lured with false promises of better wages or education, only to be trapped in cycles of poverty.

This has alarmed a movement of activists and consumers, who have placed greater scrutiny on mica’s supply chains. A small number of brands are working to ensure they’re sourcing from Responsible Mica Initiative (RMI) certified suppliers, though the lack of transparency means many mica and mica-derived products remain at risk for child labour and other serious human rights violations.

Brands using mica

‣ 1% of brands have a clear statement that they do not use mica.

‣ 11% of brands do not make products that commonly use mica.

‣ 79% of brands don’t disclose anything about their mica sourcing (even when they clearly list mica in their ingredients lists).

Responsible Mica Initiative

‣ 12% of brands almost exclusively source from suppliers that are audited against the Responsible Mica Initiative (RMI) Workplace Standard (ie for 90% or more of their mica).

Mica child labour and human rights issues

‣ 3% of brands partner with local NGOs to address issues surrounding child labour in the mica mining industry.

‣ 4% of brands have a general human rights statement on mica, but no formal policy. (Fewer than 1% of brands have a formal policy.)

Animal testing

While “cruelty-free” trends as a beauty industry buzzword, the cruelty continues. No one knows exactly how many animals are used in testing ingredients or finished beauty products each year, but estimates suggest they number, at least, into the hundreds of thousands—commonly mice, rabbits, rats, and guinea pigs. These animals are usually bred for the sole purpose of testing beauty products. And these so-called tests can involve injections, repeated skin irritation, force-feeding ingredients, force-inhaling substances, and death (sometimes of mother and offspring).

Unfortunately, very few brands achieve third-party certification that they’re animal testing-free, suggesting the practice remains too common. And since many brands in the beauty space are owned by a handful of large parent companies, brand-level claims can be deceiving, as many parent companies don’t explicitly prohibit animal testing (primarily when they sell in markets where it remains a legal requirement).

Few brands have rigorous non-animal testing certifications

‣ 78% of brands have no certification to show they’re not testing on animals.

‣ However, consumer outcry around the practice is prompting some brands to take leadership: 22% have been certified that they do not test on animals (eg certified by Leaping Bunny, PETA, the Vegan Society).

But non-certified brands are still claiming to be cruelty-free

‣ 31% of brands claim to be cruelty-free and have their own non-animal test policy of varying strength, but have not achieved a rigorous certification.

Parent companies complicate the animal testing picture

‣ Even when brands claim to be cruelty-free, their parent companies may still test on animals: 18% of brands that claim to be cruelty-free are owned by a parent company that doesn’t exclude animal testing when required by law.

Many brands simply avoid addressing the issue

‣ 30% of brands are either entirely silent on animal testing or are known to test on animals.

Closer look: animal testing inaccuracies

Beyond the obvious harms, many scientists and activists contend that animal testing is unreliable and inaccurate due to the many biological differences between humans and the other animals harmed in the process. Fortunately, advanced alternatives to animal testing have been developed in recent years. And thanks to the work of campaigners, a growing number of jurisdictions have prohibited animal testing in cosmetics. (Though the legal situation can be contradictory: for example, European Union member states prohibit animal testing in cosmetic products, but EU law still requires chemicals to be tested.) If you want to shop your values, seeking products certified by a rigorous third party is one step consumers can take.

Vegan brands

Animal cruelty in the beauty industry doesn’t end with testing. Animal-derived ingredients are commonplace, which can make it especially challenging for vegans looking to align their personal care choices with their values. But even if you’re not vegan, you may not know how extensively such ingredients are used in everyday products from mascaras and chapsticks to moisturisers and shampoos. This includes ingredients such as beeswax, honey, lanolin, carmine (red pigment derived from insects), collagen, milk protein, and squalene (for which many sharks are killed annually). Some brands are taking clear leadership and offering fully vegan product ranges, though this is presently only a fraction of the industry at large. The current reality: few beauty brands clearly state they are vegan and only a sliver are certified as such.

Only a fraction of brands are clearly vegan

‣ 9% of brands state they are vegan, though have not disclosed supporting certifications.

‣ 9% of brands are certified vegan (eg by PETA-Approved Vegan, Vegan Society, Vegetarian Society).

Animal-derived ingredients remain widespread

‣ 40% of brands clearly disclose using animal-derived ingredients (eg collagen, marine collagen, lanolin, keratin, elastin, squalene), while more brands aren’t clear on the issue.

‣ 15% of brands use ingredients derived from insects (commonly honey, beeswax, and carmine), but no other animal-derived substances.

‣ 21% of brands use ingredients that could be animal-derived (such as glycerin or stearic acid) but do not disclose their origin.

Coconut use and monkey labour

In recent years, campaigns spotlighting unethical monkey labour in coconut supply chains have raised awareness of the issue in the food and beverage sector. Campaigning has centred on coconut from Southeast Asia, and Thai sources in particular, where monkeys have been reportedly captured from the wild, caged under harsh conditions, and forced to harvest coconuts from tall trees. This controversial practice has led to boycotts and some food brands moving away from Thai-sourced coconut. Meanwhile, the Thai government has also taken some publicised steps to address international outrage, but activists maintain the practice continues in coconut supply chains.

While less frequently discussed in the context of beauty, coconut and coconut-derived ingredients are widely used in the beauty industry, too. Aware of the issue, some brands are taking steps to trace their coconut supply chain, but most have not directly addressed the concerns around abuse of these clever creatures.

Most brands use coconut

‣ 83% of brands appear to use coconut-derived ingredients in at least some of their products.

Most brands can’t confirm even where their coconut comes from

‣ 67% of brands cannot confirm if monkey labour occurs in their supply chain or if their coconut is sourced from Thailand.

‣ 13% of brands state that they are taking efforts to trace their coconut, but haven’t clearly addressed monkey labour.

‣ Fewer than 1% of brands have directly engaged suppliers on the issue of monkey labour to ensure none is used in their coconut supply chain.

Part 2: how beauty brands rate (best to worst)

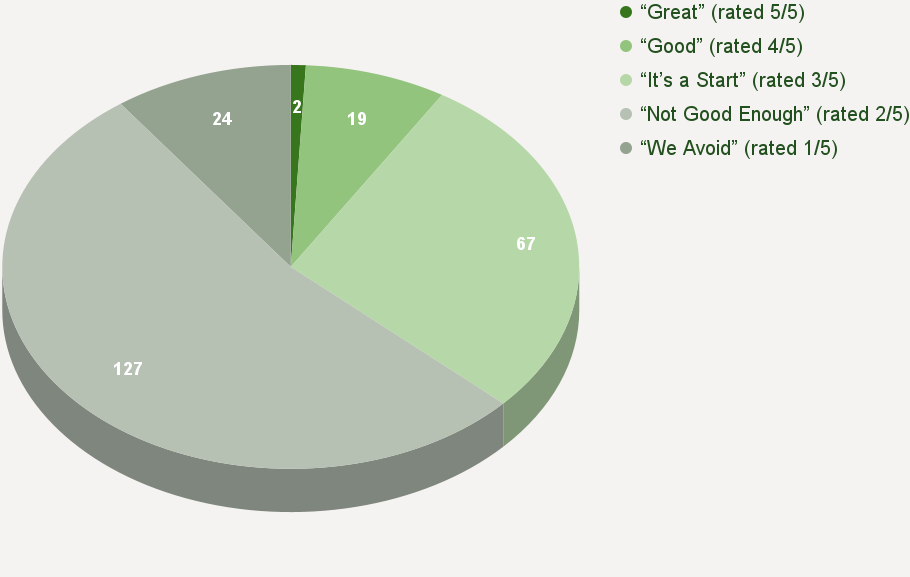

When Good On You’s analysts complete a brand rating, each brand receives a score out of 100, which gives an unweighted view of how a brand performs across the three key rating pillars (people, planet, and animals), assessed based only on publicly available information to promote transparency across the beauty industry. This score reflects the complexity of the issues covered in the methodology. But one of our key rating principles is making that information accessible to consumers at a glance, so we then group brands into a five-point rating scale—ie graded on a curve to help consumers more easily identify who “We Avoid” (1/5) and who is “Good” (4/5) and “Great” (5/5).

Ratings distribution for the beauty industry

The following table and chart show the distribution of 239 beauty brands, large and small, based on the five-point rating scale (ie graded on the curve). Unfortunately, the largest slice of the pie is rated “Not Good Enough” (2/5), indicating the industry lags when it comes to meaningful sustainability.

| Rating label (out of 5) | Number of brands | Percentage |

|---|---|---|

| “Great” (5/5) | 2 | 1% |

| “Good” (4/5) | 10 | 8% |

| “It’s a Start” (3/5) | 67 | 28% |

| “Not Good Enough” (2/5) | 127 | 53% |

| “We Avoid” (1/5) | 24 | 10% |

Figure 1: overall ratings (distribution of 239 brands)

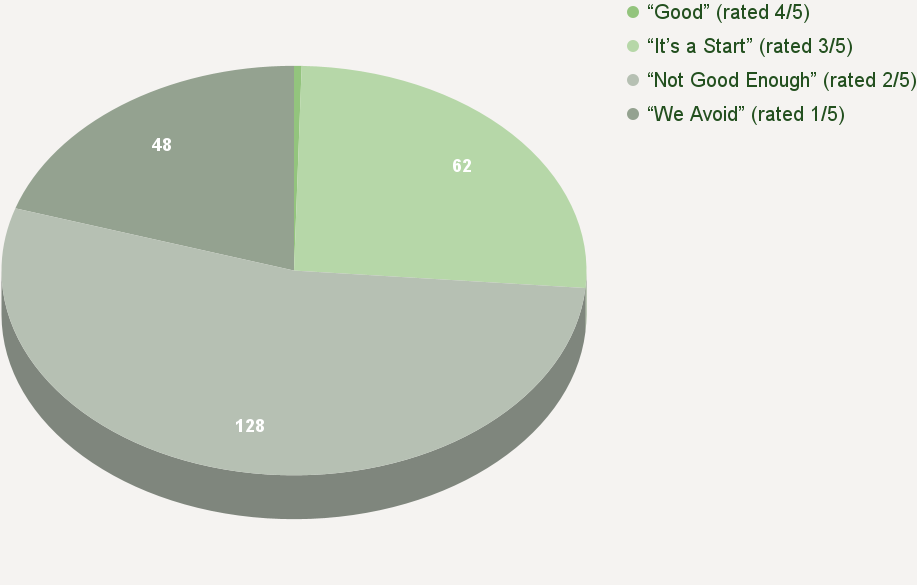

Figure 2: labour ratings (distribution of 239 brands)

No brands rated “Great” (5/5) on labour. Only one brand rated “Good” (4/5).

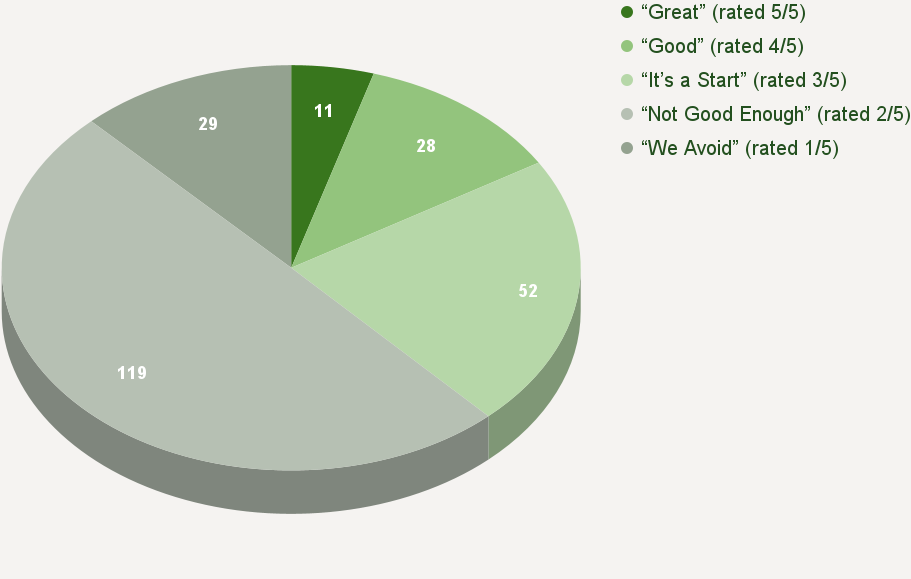

Figure 3: planet ratings (distribution of 239 brands)

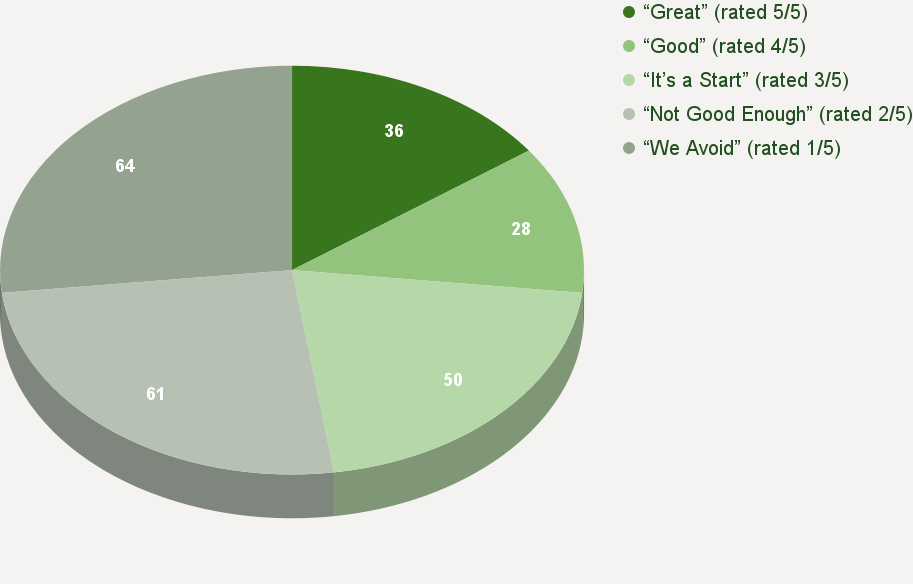

Figure 4: animal ratings (distribution of 239 brands)

Best and worst rated brands

The following brands rated at the top or bottom of our initial ratings of 239 brands based on the publicly available information Good On You considers in rating beauty brands. To be clear, this doesn’t necessarily mean these top rated brands are the most sustainable out there—they’re simply the top performing based on the brands we’ve reviewed so far. What we see are a few small brands ahead of the curve, with more circular and innovative business models. However, large brands tend to lag behind, and even for the smaller number of top rated large brands, they’re still not doing enough to tackle problems such as packaging waste through, say, circular economy principles, which are a couple of the 42 key issues Good On You rates in beauty.

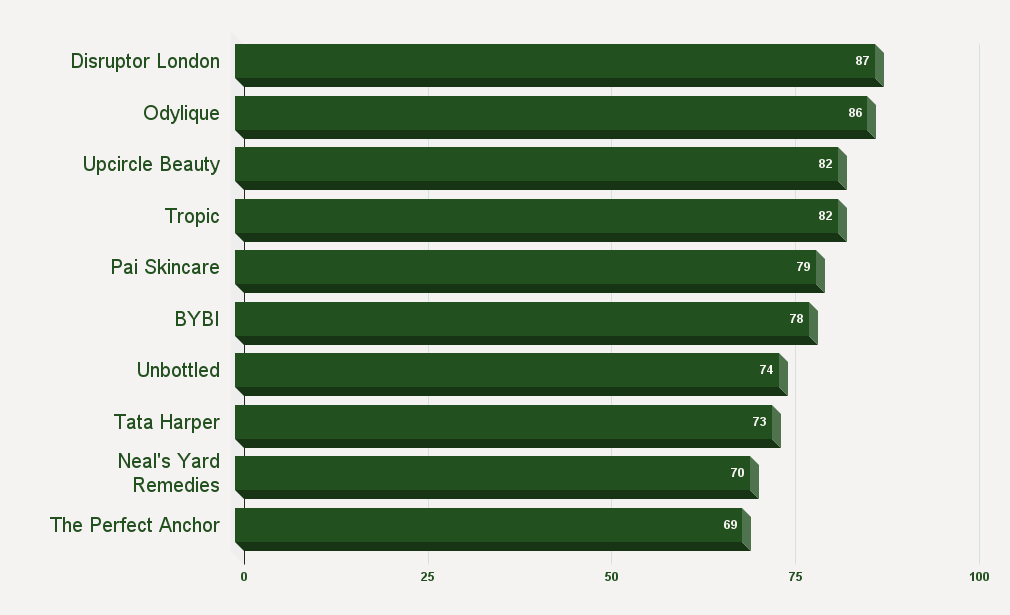

10 best rated small brands

Small brands in this sample generally score higher than large brands, with the following 10 brands coming out on top based on the initial 239 brands assessed for the scorecard. Notably, only two brands—both small—received our top “Great” (5/5) rating.

| Brand name | Rating label | Score (out of 100) |

|---|---|---|

| Disruptor London | “Great” (5/5) | 87 |

| Odylique | “Great” (5/5) | 86 |

| Upcircle Beauty | “Good” (4/5) | 82 |

| Tropic | “Good” (4/5) | 82 |

| Pai Skincare | “Good” (4/5) | 79 |

| BYBI | “Good” (4/5) | 78 |

| Unbottled | “Good” (4/5) | 74 |

| Tata Harper | “Good” (4/5) | 73 |

| Neal’s Yard Remedies | “Good” (4/5) | 70 |

| The Perfect Anchor | “Good” (4/5) | 69 |

Figure 5: Top small brands (by score out of 100)

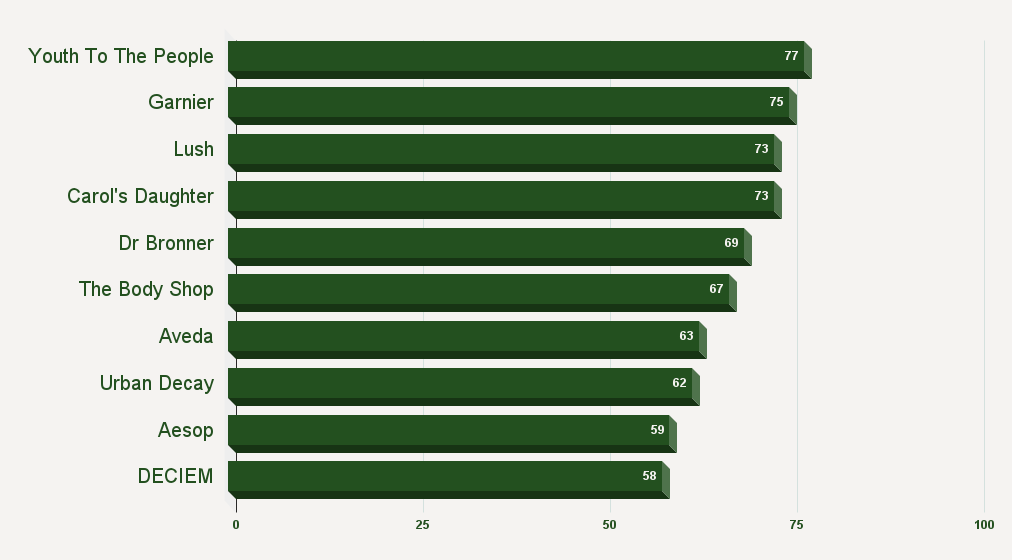

10 best rated large brands

Large brands tend to score poorly, with only six achieving the “Good” (4/5) rating. The vast majority of large brands rate low on the ratings scale, but these 10 are ahead of the curve among the initial 239 brands assessed for the scorecard.

| Brand name | Rating label | Score (out of 100) |

|---|---|---|

| Youth To The People | “Good” (4/5) | 77 |

| Garnier | “Good” (4/5) | 75 |

| Lush | “Good” (4/5) | 73 |

| Carol’s Daughter | “Good” (4/5) | 73 |

| Dr Bronner | “Good” (4/5) | 69 |

| The Body Shop | “Good” (4/5) | 67 |

| Aveda | “It’s a Start” (3/5) | 63 |

| Urban Decay | “It’s a Start” (3/5) | 62 |

| Aesop | “It’s a Start” (3/5) | 59 |

| DECIEM | “It’s a Start” (3/5) | 58 |

Figure 6: Top large brands (by score out of 100)

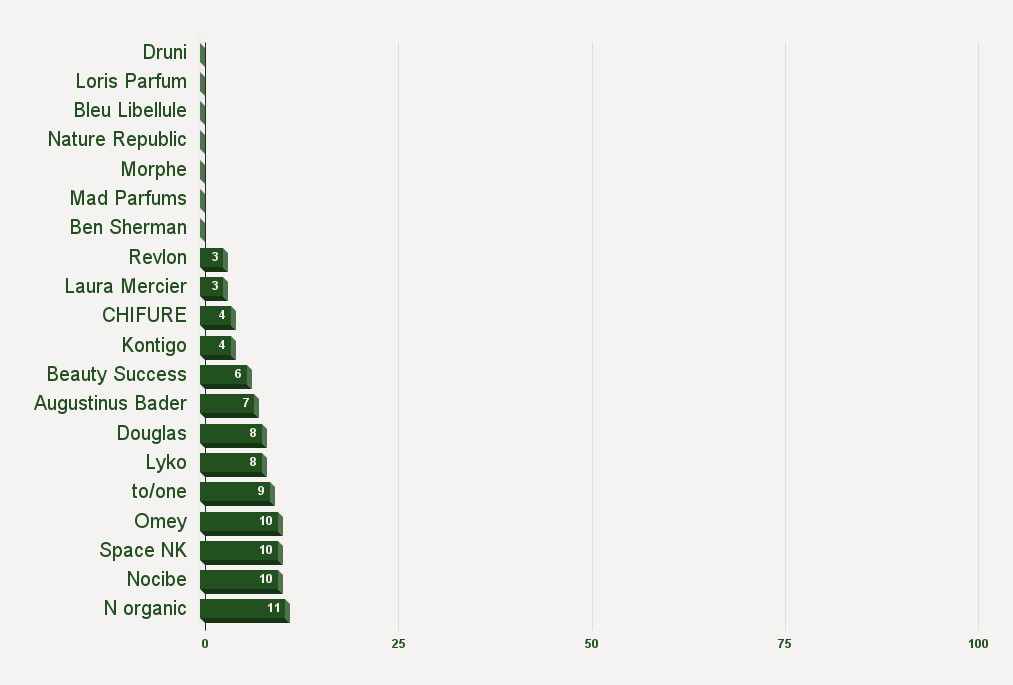

20 worst rated large brands

We proportionately apply more demanding standards to large brands as they inherently have greater impacts and influence. But, alas, many large brands are doing the least, including these 20.

| Brand name | Rating label | Score (out of 100) |

|---|---|---|

| Druni | “We Avoid” | 0 |

| Loris Parfum | “We Avoid” | 0 |

| Bleu Libellule | “We Avoid” | 0 |

| Nature Republic | “We Avoid” | 0 |

| Morphe | “We Avoid” | 0 |

| Mad Parfums | “We Avoid” | 0 |

| Ben Sherman | “We Avoid” | 0 |

| Revlon | “We Avoid” | 3 |

| Laura Mercier | “We Avoid” | 3 |

| CHIFURE | “We Avoid” | 4 |

| Kontigo | “We Avoid” | 4 |

| Beauty Success | “We Avoid” | 6 |

| Augustinus Bader | “We Avoid” | 7 |

| Douglas | “We Avoid” | 8 |

| Lyko | “We Avoid” | 8 |

| to/one | “We Avoid” | 10 |

| Omey | “Not Good Enough” | 10 |

| Space NK | “Not Good Enough” | 10 |

| Nocibe | “Not Good Enough” | 10 |

| N organic | “Not Good Enough” | 11 |

Figure 7 : Bottom large brands (by score out of 100)